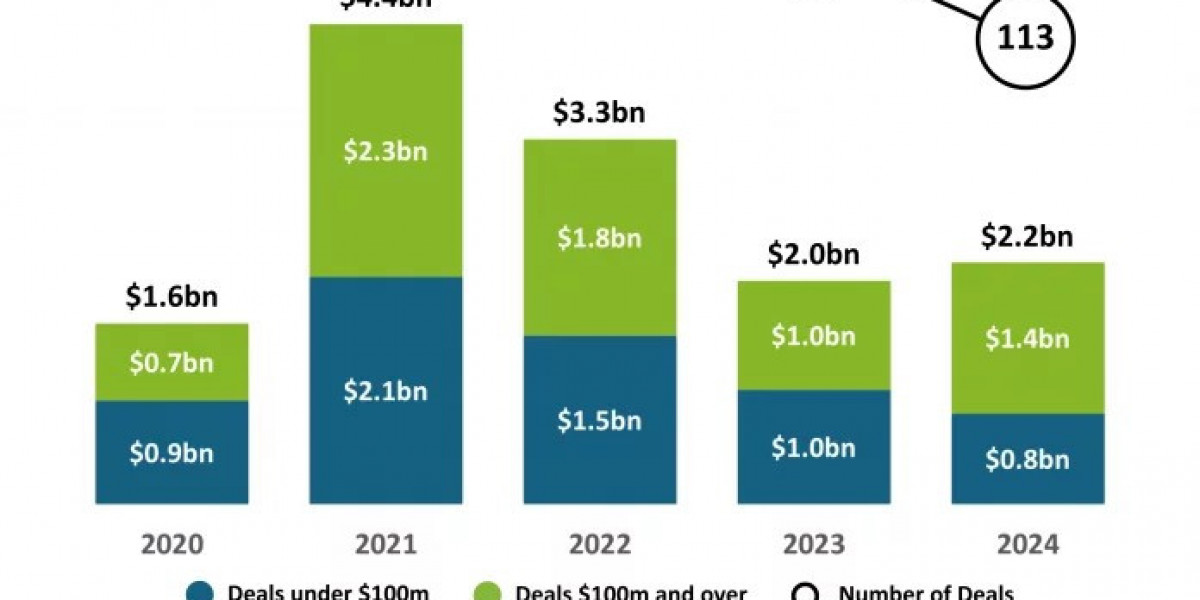

In 2024, Canadian fintech funding saw an 8% increase, with a noticeable preference among investors for deals exceeding $100 million. This surge signals a growing confidence in the scalability of Canada's fintech industry and a clear shift toward backing more established companies with proven business models. As the sector continues to evolve, investors are increasingly drawn to firms that exhibit significant market impact and long-term growth potential. This trend mirrors global shifts within fintech, where there is an increasing emphasis on sustainability, profitability, and security in financial transactions.

Just as Canadian investors are looking for robust companies capable of navigating market complexities, fintech companies worldwide are focused on building secure, accessible, and user-friendly solutions. Modern banking apps, digital payment platforms, and real-time payment systems are reshaping how people engage with financial services, ensuring that consumers can access their accounts anytime and anywhere.

From simplifying cross-border payments to ensuring high levels of security through advanced payment gateways, fintech innovations are propelling the financial services sector into a new era. As demand for mobile banking apps, international money transfer tools, and secure investment platforms continues to grow, fintech will drive further advancements in financial inclusion and innovation, marking a promising future for the industry.