United States Movie Market Size, Share, Trends, Forecast 2025–2033

Renub Research Latest Report Analysis & Forecast

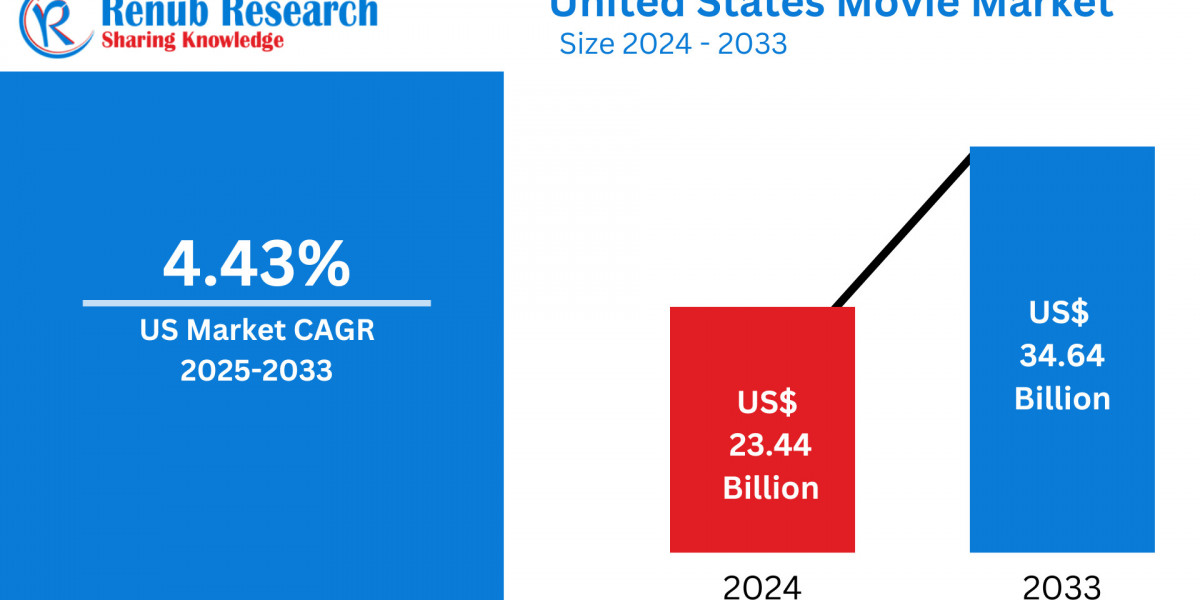

The United States Movie Market is projected to reach US$ 34.64 Billion by 2033, growing from US$ 23.44 Billion in 2024, at a CAGR of 4.43% during the forecast period 2025–2033. This consistent growth is driven by the evolving consumption preferences, booming streaming platforms, and continued investments in cinematic innovations. As a global entertainment powerhouse, the U.S. remains a focal point for production, distribution, and cultural influence.

Market Overview

Movies—an amalgamation of storytelling, visuals, sound, and performance—serve as a major cultural touchstone and source of entertainment in the U.S. These audiovisual narratives span diverse genres, including action, comedy, romance, horror, and science fiction, offering something for every demographic.

The United States has been the cradle of cinematic excellence with Hollywood positioned as the global epicenter of movie production. Despite changing viewer habits, particularly the surge of streaming services, the country continues to innovate and dominate in both production value and global content distribution.

Key Market Drivers

1. Technological Advancements in Production & Viewing

- The use of CGI, VR/AR, and IMAX technology has elevated movie experiences.

- High-definition, immersive audio and visual storytelling attract tech-savvy consumers.

- Streaming platforms allow content access across devices, catering to a mobile-first audience.

Example: In August 2024, Cosmo Films launched seven new tech-enabled products targeting the film and label segment in the U.S., enhancing visual quality and print durability in movie packaging and promotion.

2. Rise of Franchise Films

- Franchises like Marvel, Star Wars, and Fast & Furious generate billions in revenue.

- Loyal fanbases lead to sustained interest across sequels, spin-offs, and merchandise.

- Such films offer consistent box office returns, driving market reliability.

3. Streaming Services Revolution

- Platforms like Netflix, Disney+, HBO Max, and Amazon Prime Video continue to reshape movie consumption.

- Exclusive releases and original content provide alternatives to theater visits.

Notable Developments:

- In Jan 2024, Netflix secured a $5 billion deal with WWE and a $150 million NFL Christmas game broadcast agreement, showcasing its expansion into live and exclusive content.

- Exclusive U.S. rights for the FIFA Women’s World Cup further diversify its entertainment portfolio.

Market Challenges

1. Declining Theatrical Attendance

- The rise of home entertainment, amplified during the COVID-19 pandemic, has significantly reduced footfall in movie theatres.

- High ticket prices and limited regional availability further discourage in-person viewing.

2. Piracy and Illegal Streaming

- Widespread digital piracy results in revenue losses for studios and streaming services.

- Content leaks diminish premiere excitement and profitability.

- Despite digital rights management, combating piracy remains an uphill battle.

New Publish Reports

· United States Biscuits Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Regional Insights

Arizona Movie Market

Arizona leverages its natural beauty, cost-effectiveness, and incentives to attract filmmakers. Festivals like the Phoenix Film Festival and active indie film communities fuel local industry growth.

California Movie Market

As the heart of global cinema, California—with Hollywood at its core—hosts major studios, production houses, and creative talent. The state also supports large-scale productions and film festivals like Sundance, encouraging both mainstream and indie success.

New York Movie Market

New York thrives with diverse filming locations, substantial tax credits, and a mix of blockbusters and indie films. Events such as the Tribeca Film Festival and robust infrastructure make it a leading hub for creative storytelling.

Washington Movie Market

Washington is gaining ground with scenic diversity and filmmaker incentives. Seattle, in particular, has emerged as a hub for independent cinema, supported by the Seattle International Film Festival and community-driven production efforts.

United States Movie Market Segmentation

By Distribution Income

- Income from Movie Tickets

- Advertisement Revenue

- Sale of Food & Beverages

- Others

By Screen Type

- Digital non-3D

- Digital 3D

- Others

By Gender

- Male

- Female

By Age Group

- 2–11 Years

- 12–17 Years

- 18–24 Years

- 25–39 Years

- 40–49 Years

- 50–59 Years

- 60+ Years

By States (38 States + Others)

Includes top markets like California, New York, Texas, Florida, Washington, Arizona, and more.

Competitive Landscape: Company Analysis

Each company profile covers:

- Overview

- Recent Developments

- Revenue

Key Players:

- Cinemark Holding, Inc.

- Regal Cinemas

- CGV Cinemas

- AMC Theatres

- Marcus Theatres

- B&B Theatres

- AMC

- Empire Cinema

Key Questions Answered

- What is the expected market size of the U.S. movie industry by 2033?

- What is the projected CAGR from 2025 to 2033?

- Which income streams are shaping the U.S. movie market landscape?

- How is the streaming evolution impacting traditional theaters?

- What technologies are contributing to industry growth?

- What role do franchise films play in box office success?

- How does piracy affect market revenue?

- Which states demonstrate the highest growth potential?

- How do demographic factors influence viewership patterns?

Report Details

Feature | Details |

Base Year | 2024 |

Historical Period | 2020–2024 |

Forecast Period | 2025–2033 |

Market Units | US$ Billion |

Segments Covered | Distribution Income, Screen Type, Gender, Age Group, States |

States Covered | 38 States + Others |

Companies Covered | 8 Major Players |

Delivery Format | PDF, Excel (Editable PPT/Word on request) |

Customization Scope | 20% Free |

Analyst Support | 1 Year |

Customization Services Available

- Market Size Deep Dive

- Additional Company Profiling

- Region-Specific Analysis

- Market Entry & Strategy Consultation

- Production & Trade Data

- Competitive Benchmarking

For More Information

? USA: +1-478-202-3244

? India: +91-120-421-9822

? Email: info@renub.com