GCC Foodservice Market Size, Share, Forecast & Trends (2025–2033): In-Depth Analysis by Segment, Outlet, Country & Key Players

Market Overview

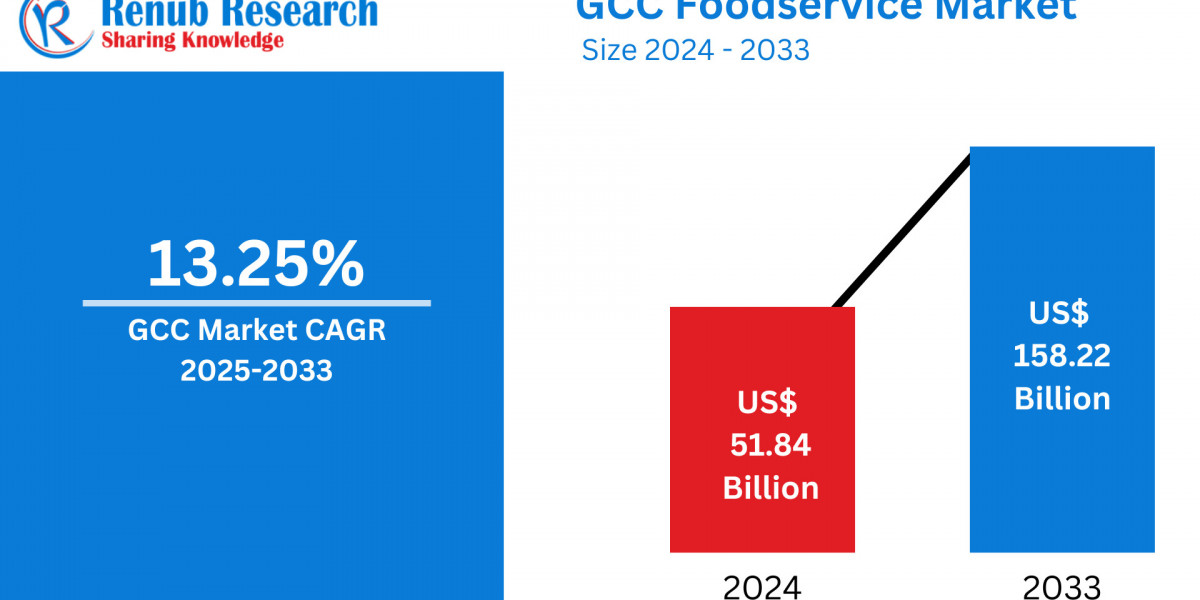

The GCC foodservice market is poised for substantial growth, forecasted to reach US$ 158.22 billion by 2033, up from US$ 51.84 billion in 2024, expanding at a robust CAGR of 13.25% from 2025 to 2033. This growth is propelled by a confluence of macroeconomic trends including rapid urbanization, increasing disposable incomes, rising health consciousness, a surge in tourism, and major digital transformation across the sector. The GCC countries—particularly Saudi Arabia, UAE, and Qatar—are leading the shift towards a diversified and competitive foodservice landscape.

Key Questions Answered in this Report

- What is the current size and future forecast of the GCC foodservice market?

- What are the primary drivers and challenges impacting market growth?

- Which foodservice types and outlets are gaining the most traction?

- Which countries are leading the GCC market and why?

- Who are the major companies shaping the GCC foodservice industry?

- How is the surge in tourism and digital transformation influencing the market?

- What strategies can stakeholders adopt to thrive in this evolving space?

Market Dynamics

Growth Drivers

1. Rapid Urbanization and Youth-Centric Demographics

Urban migration is accelerating across the GCC, particularly in cities like Riyadh, Dubai, and Doha. The burgeoning youth population, characterized by openness to global cuisines and dining formats, is reshaping food consumption patterns and fueling demand for quick service and hybrid culinary models.

2. Rising Disposable Incomes

Increased affluence, especially among middle-income groups and young professionals, is resulting in higher expenditure on experiential dining and convenience-based services like food delivery and smart-ordering systems.

3. Tourism as a Catalyst

Mega-events like Expo 2020 in Dubai and the FIFA World Cup in Qatar have had a profound impact on foodservice demand. A sustained focus on global tourism as a pillar of economic diversification continues to generate demand for a variety of international and regional cuisines.

4. Technological Advancements

Digitalization is revolutionizing the market. From AI-powered delivery platforms to cloud kitchens and contactless dining, tech-savvy consumers are driving operational and experiential innovation in the foodservice space.

Key Challenges

1. Sustainability and Food Waste

The foodservice industry faces mounting pressure to adopt eco-friendly practices. Issues include food waste, plastic packaging, and energy-intensive operations. Implementing sustainable supply chains and waste management systems, while costly, is becoming crucial to long-term competitiveness.

2. Volatile Food Prices

The region’s dependency on imports exposes the market to price volatility caused by global supply chain disruptions, tariffs, or geopolitical tensions. This affects margins and forces operators to be agile with sourcing and pricing strategies.

Related Report

Market Segmentation: In-Depth Analysis

By Foodservice Type

- Cafes & Bars: The café culture, especially in the UAE, is booming, driven by local and international coffee chains.

- Cloud Kitchens: Gaining momentum with low overheads and high scalability, cloud kitchens cater to the on-demand delivery economy.

- Full-Service Restaurants (FSRs): These continue to attract a growing base of high-income customers and tourists looking for experiential dining.

- Quick-Service Restaurants (QSRs): Dominated by global giants, QSRs are localizing menus to cater to regional tastes.

By Outlet

- Chained Outlets: Expansion of global and regional franchises offering standardized experiences.

- Independent Outlets: Local eateries and boutique establishments play a key role in offering niche cuisines and personalized service.

By Location

- Leisure: High footfall in malls and entertainment hubs drives foodservice demand.

- Lodging: Hotel-based foodservice benefits from tourism inflows.

- Retail: Supermarkets and department stores are integrating food counters.

- Standalone: Independent outlets are popular in densely populated urban centers.

- Travel: Airports and transit locations offer a mix of QSRs and premium dining.

Country-Wise Analysis

United Arab Emirates (UAE)

With over 6 million cups of coffee consumed daily and 13,000+ cafés and restaurants in Dubai, the UAE is at the forefront of culinary innovation. High tourism and expat influx fuel a dynamic food culture focused on sustainability and premiumization.

Saudi Arabia

Home to one of the youngest populations in the world, Saudi Arabia’s foodservice sector is booming under Vision 2030. Cities like Riyadh and Jeddah are witnessing the rise of hybrid dining formats and wellness-oriented cuisines.

Qatar

Qatar is leveraging its post-World Cup infrastructure to further expand hospitality and foodservice offerings. Demand for high-end restaurants and fusion cuisines is rising, particularly among affluent consumers and tourists.

Kuwait

With a growing affinity for international cuisines and premium delivery options, Kuwait's youth and professional class are driving demand for tech-enabled and health-focused foodservice experiences.

Bahrain

A compact but affluent market, Bahrain is experiencing increasing demand for organic, calorie-conscious, and gourmet food. Business tourism and Formula 1 events also contribute to seasonal spikes in foodservice demand.

Oman

Though relatively nascent, Oman’s market is expanding with rising urbanization and the government's push for economic diversification through tourism and retail growth.

Competitive Landscape: Key Players

- Al Tazaj Fakeih

- Alamar Foods Company

- ALBAIK Food Systems Company SA

- Galadari Ice Cream Co. Ltd LLC

- Herfy Food Service Company

- Kudu Company for Food and Catering

- LuLu Group International

- Riyadh International Catering Corporation

- Shahia Food Limited Company

These companies are focusing on menu diversification, supply chain optimization, and regional expansion to capture growing demand.

Report Deliverables

Feature | Details |

Base Year | 2024 |

Historical Coverage | 2020–2024 |

Forecast Period | 2025–2033 |

Format | PDF + Excel (PPT/Word on request) |

License Options | Single User ($2,990), Five Users ($3,490), Corporate ($3,990) |

Free Customization | Up to 20% |

Analyst Support | 1 Year |

Coverage | Foodservice Type, Outlet Type, Location, Country |

Customization Options

- Market entry strategy

- Trade and production analysis

- Country-specific insights

- More company profiles (up to 10 additional free)

- Segment-level trends and forecasts

FAQs

How big is the GCC foodservice market?

Valued at US$ 51.84 billion in 2024, it is projected to grow to US$ 158.22 billion by 2033.

What is the market growth rate?

The market is growing at a CAGR of 13.25% from 2025 to 2033.

Which region holds the largest market share?

The UAE and Saudi Arabia are the dominant markets due to tourism, urbanization, and diversified consumer bases.

What segments are covered?

Foodservice Type, Outlet Type, Location, and Country-Level Markets.

About Renub Research

Renub Research is a global market research and consulting firm with over 15 years of experience. We specialize in international B2B analysis across multiple industries, helping clients make informed decisions and unlock new growth opportunities.

? Contact Us

USA: +1-478-202-3244

India: +91-120-421-9822

? Email: info@renub.com